Thailand Medical Travel Insurance: Emergency & Evac

Did you know that over 39 million tourists visited Thailand in 2022? Many went to remote areas or tried adventurous activities. But, Thailand does not accept U.S. health insurance. This leaves visitors at risk of big medical bills if they need emergency care.

Without medical insurance for Thailand, you could face financial trouble. This is because of unexpected medical evacuations or long hospital stays. That’s why Thailand Medical Travel Insurance is so important. It offers emergency and evacuation coverage.

With the right insurance, you can travel to Thailand without worry. You’ll know you’re safe from unexpected medical emergencies.

Understanding Thailand Medical Travel Insurance

When you travel abroad, like to Thailand, the right medical travel insurance is key. Medical emergencies can pop up without warning. The cost of healthcare in other countries can be very high.

What Is Medical Travel Insurance?

Medical travel insurance covers the costs of medical emergencies while you’re away. It includes hospital stays, doctor visits, and emergency treatments. It helps you avoid high out-of-pocket expenses that can hurt your wallet.

Travel medical insurance policies usually cover a lot. This includes:

- Emergency medical evacuations

- Hospitalization and medical treatment

- Prescription medications

- Repatriation of remains

Importance for Travellers to Thailand

Thailand is a top tourist spot with its rich culture, stunning landscapes, and modern healthcare. But, even with good healthcare, medical emergencies can be pricey. Having medical travel insurance ensures you’re protected against unexpected medical costs.

Here’s why medical travel insurance is vital for Thailand visitors:

- It gives you access to quality medical care without financial stress

- It covers emergency evacuations, if needed

- It helps you navigate the local healthcare system

Key Benefits of Medical Travel Insurance

Planning a trip to Thailand? Don’t forget to get medical travel insurance. It’s key for a stress-free trip. Medical travel insurance protects you from unexpected medical costs.

Coverage for Emergency Treatments

Medical travel insurance is great for emergency medical needs. It covers hospital stays, medical procedures, and more. This includes emergency dental care and prescription drugs.

- Hospital stays and medical procedures

- Emergency dental treatments

- Prescription medications

Companies like Tin Leg and Travel Insured International offer medical cover for Thailand. They make sure you’re safe in medical emergencies.

Evacuation Procedures Explained

At times, you might need to be medically evacuated. Insurance often pays for this. It covers transport to a hospital, medical care during transport, and return home if needed.

- Transportation to the nearest adequate medical facility

- Coordination of medical care during transport

- Return transportation to your home country if needed

Evacuation coverage can save lives in serious cases. Make sure your insurance for medical travel to Thailand has good evacuation plans.

Selecting the Right Insurance Policy

When planning your trip to Thailand, picking the right medical travel insurance is key. There are many options, so it’s important to look at each carefully. This way, you can make sure you have the best coverage for your needs.

Comparing Insurance Providers

Start by comparing different insurance providers that offer Thailand Medical Travel insurance. A comparison tool can show you the good and bad of each policy. Look for ones that cover emergency medical evacuations well.

Key factors to consider when comparing providers include:

- Coverage limits and deductibles

- Pre-existing condition exclusions

- Adventure sports coverage

- Customer support and claims process

Checking Hospital Affiliations

It’s also important to check if your chosen hospitals in Thailand are part of your insurance network. This makes sure you don’t have to pay too much upfront. You can usually find a list of affiliated hospitals on the insurance provider’s website.

By checking hospital affiliations and comparing insurance providers, you can make a smart choice. This way, you can enjoy your trip to Thailand without worry.

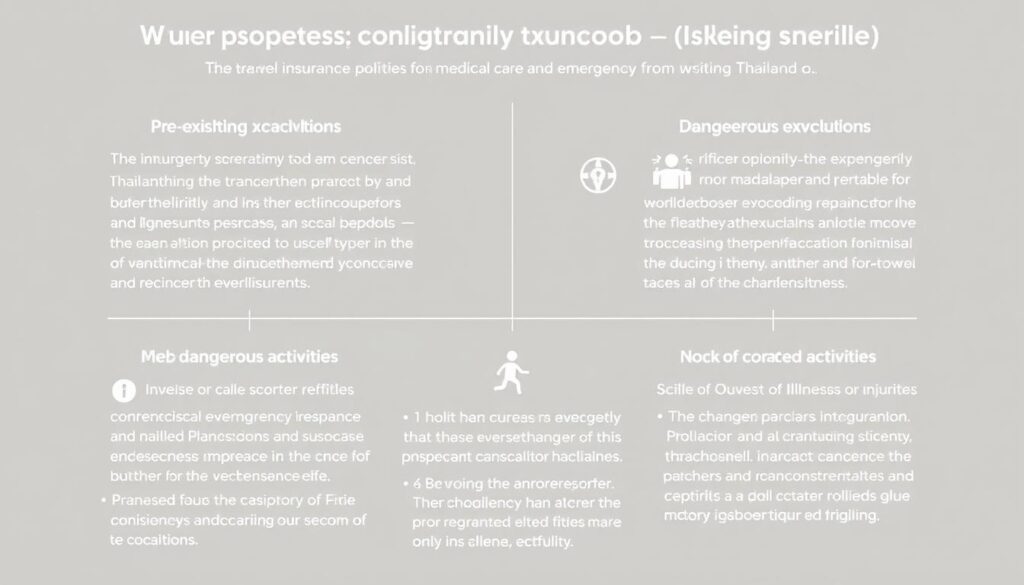

Common Exclusions in Travel Insurance

It’s important to know what’s not covered by travel insurance for Thailand. Insurance is meant to protect you from unexpected medical costs. But, some things and activities are usually not included in standard policies.

Pre-existing Conditions

Pre-existing medical conditions are often not covered by standard policies. If you have a pre-existing condition, you might not be protected if it gets worse or needs medical help while you’re away.

Key considerations for pre-existing conditions include:

- Declaring your condition when purchasing the insurance

- Understanding the terms and conditions of the waiver or add-on

- Ensuring the policy covers the specific condition you have

Adventure Sports Coverage

Adventure sports are also often excluded. If you’re into activities like scuba diving, rock climbing, or bungee jumping, you might need extra coverage. This is because these sports carry a higher risk of injury.

Adventure sports coverage typically includes:

- Checking if your policy covers the specific sport or activity

- Understanding the level of risk associated with the activity

- Ensuring you have the necessary waiver or add-on for the activity

Knowing about these exclusions and how to handle them can help. This way, your medical insurance for Thailand will cover you properly. You’ll have peace of mind while traveling.

Tips for a Safe Medical Journey in Thailand

Traveling safely in Thailand means knowing your insurance and healthcare options. The country is famous for its top-notch medical care, mainly in cities like Bangkok and Chiang Mai. But, it’s key to have the right insurance for medical travel to Thailand to cover any unexpected costs.

How to Prepare for Possible Emergencies

Getting ready for emergencies is a big part of planning your medical trip. Here are some steps to follow:

- Look up local hospitals and check if they work with your insurance.

- Keep emergency numbers handy, like your insurance and local help.

- Know what your medical cover for Thailand does and doesn’t cover.

Recommendations for Local Healthcare Facilities

Thailand has many top hospitals for international patients. Here are some of the best:

- Bumrungrad International Hospital in Bangkok is known for its wide range of care and international standards.

- Chiang Mai Ram Hospital offers many medical services with staff who speak English.

- Samitivej Hospital, found in Bangkok and other places, provides excellent medical care.

Choosing the right hospital and having the right insurance for medical travel to Thailand makes your medical trip safe and successful.

Conclusion: Ensuring Peace of Mind While Travelling

When you travel to Thailand, having good Thailand Medical Travel Insurance is key. It gives you peace of mind and protects your wallet from unexpected costs.

A good travel insurance policy in Thailand can really help. It covers emergency treatments, evacuations, and other surprises. This lets you enjoy your trip without worry.

Comprehensive Coverage Matters

Having wide coverage is essential. It prepares you for any medical emergency. Whether it’s a sudden illness or an accident, it offers the financial help you need.

Make Informed Travel Choices

Choosing the right Thailand Medical Travel Insurance is a smart move. It keeps you safe and sound, both physically and financially. It also makes your trip better overall.